Better Businesses Have

Sustainable Growth

Companies that perform well on sustainability issues which are material for their business financially outperform companies that don’t prioritize these issues, or that prioritize immaterial sustainability issues. While sustainable growth looks different for each company, one thing remains the same — management teams that integrate sustainability considerations with rigor and nuance build businesses that create more sustainable long-term value.

CASE STUDIES FEATURED

89% of majority-owned companies in our US Buyout fund have built diverse boards within the first two years of our ownership

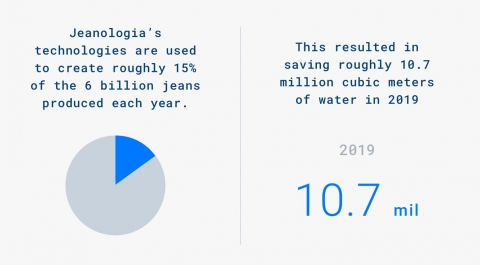

We track ESG data so that we can make better investment decisions and build better, more sustainable businesses. Carlyle Europe Partners is in its fourth year of tracking material, bespoke ESG key performance indicators (KPIs) across its portfolio companies, which has led to even more use cases than we originally envisioned. Last year we profiled one of those companies, Jeanologia, a Valencia, Spain-based portfolio company at the forefront of sustainable and eco-efficient technologies for manufacturing denim, which focuses on significantly reducing the amount of water and chemical usage in finishing processes. Jeanologia tracks a series of material ESG KPIs that range from energy management to employee health and safety.

75+ public case studies of tailored ESG value creation across our portfolio companies

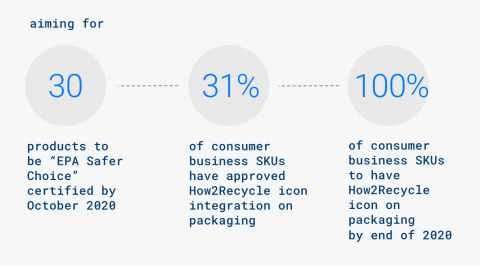

As the world shifts towards reducing excess packaging and single-use plastic, skeptics might see an industry with headwinds – however traditional packaging companies are instead seeing new significant business opportunities in responding to this demand. Innovations in raw materials, design and manufacturing practices can reduce environmental footprints, while also ensuring that needed products – such as safe and hygienic food storage options, vital medical equipment, and indispensable trash can liners – remain accessible and effective. Novolex, a packaging company that Carlyle acquired in 2017, has made a concerted push to reduce waste and use technologies to create new products that meet the evolving sustainability goals of its customers and markets.

Card Text: Building the next generation of sustainable packaging

Novolex Now Offers Can Liners With 50 Percent Post-Consumer Recycled Content

Across the globe, CommScope’s people and solutions are redefining network connectivity, solving today’s challenges and driving the innovation that will meet the needs of what’s next – increasingly that has meant focusing on the environmental and social dimensions of CommScope’s business. Consumer preferences are changing, environmental regulation is ratcheting up, and workforce engagement is increasingly critical to keeping a competitive edge.

In early 2019, when our deal team was looking into an investment in Weiman, they saw a strong operation and a leader in all manner of specialty cleaning products for the home. Our ESG team identified the key growth area for the company: a more-intentional focus on sustainable and safe-to-use products, in response to evolving consumer demand. The investment team agreed, and put a sustainability expert with a background in chemical engineering on the Company's Board of Directors from the outset.

Key Goals & Stats

OUR IMPACT AT CARLYLE

What we’re doing at Carlyle about Sustainable Growth

Annual Sustainability Workshop

Leadership and learning go hand-in-hand, and our portfolio companies continue to lead on ESG issues by learning from each other on these important topics. Our portfolio companies are frequently at the forefront of specific ESG innovations – from how they are managing ESG issues themselves to how they are developing products and services that could help other portfolio companies capitalize on ESG risk management and value creation opportunities.

These innovations can be leveraged across our companies – something we actively work to facilitate. In December Carlyle hosted its annual Sustainability Workshop for our portfolio companies, welcoming participants from 15 different portfolio companies for a day of discussion, information sharing, and problem solving on pressing ESG topics.

Our Co-CEO Glenn Youngkin kicked off the day by highlighting the rising importance of ESG themes such as climate change and diversity and inclusion in his conversions with our global LPs, and in how he thinks about creating long-term value for our investors. Carlyle portfolio company IsoMetrix walked through case studies of how they have deployed their enterprise software solutions for managing ESG data at other Carlyle companies to help drive better decision making, and in-house experts such as Kara Helander, Carlyle’s Chief Inclusion & Diversity Officer, shared practical tips and advice about how to build inclusive and diverse cultures within organizations. Leadership on ESG issues isn’t accomplished by going at it alone – we know we can all do more by learning from each other.

ESG Training and Education at Carlyle

What’s the better approach: a dedicated ESG team, or ESG integration embedded across investment professionals? Our view is that it’s not an either/or – you need both. We believe it is important to have both dedicated in-house ESG expertise to drive learning, best-practice, and education on emerging ESG issues, as well as broad-based responsibility for ESG matters across investment teams so that ESG is inextricably embedded into the investment process.

Carlyle has a dedicated global team of internal ESG professionals based between Washington DC, New York, and London, led by Carlyle’s Global Head of Impact. The ESG team not only works closely with our deal teams on investments – providing hands-on guidance – but also holds regular trainings with investment professionals across levels to provide education on ESG frameworks – such as SASB – on how to create tailored value-creation plans, and emerging ESG thematic issues.

ESG Data in action

ESG data is a hot topic of conversation across the investment world. And for good reason – this data is critical to effectively integrating, improving, and monitoring material ESG issues across investments. Collecting data for data’s sake isn’t particularly helpful, however – so we are careful to collect data that has specific use cases and applications.

We track bespoke ESG key performance indicators (KPIs) for certain investments – for example, Carlyle Europe Partners is in its fourth year of collecting company-specific material ESG KPIs. In 2019 we expanded that work to track broad-based KPIs that are relevant across our diverse geographies and assets, such as data on the diversity of company boards.

Both approaches – the “micro” of company-specific data, and the “macro” of cross-portfolio information – play different but increasingly vital roles in our investment process. Tailored, materiality-based data help us identify risks and opportunities, create bespoke value-creation plans, and measure progress over time for companies. Portfolio-wide data helps us understand and manage systemic risks, such as those posed by climate change, and perform more comprehensive research on value creation drivers, such as research we performed which quantified the correlation between board diversity and annual earnings growth across our portfolio companies. This data is also useful for communicating with our LPs and broader stakeholders.

While ESG data is relevant across our investment activity, for certain investment strategies that align with impact themes, such as our Renewable and Sustainable Energy platform, we also track bespoke impact metrics, such as megawatts of clean energy installed and greenhouse gas emissions avoided.

ESG data is powerful when approached with nuance, rigor, and an investment mindset – collecting ESG data for the sake of collecting ESG data misses the mark.